Full lifecycle

One system for the entire journey

For all parties involved throughout a private investment

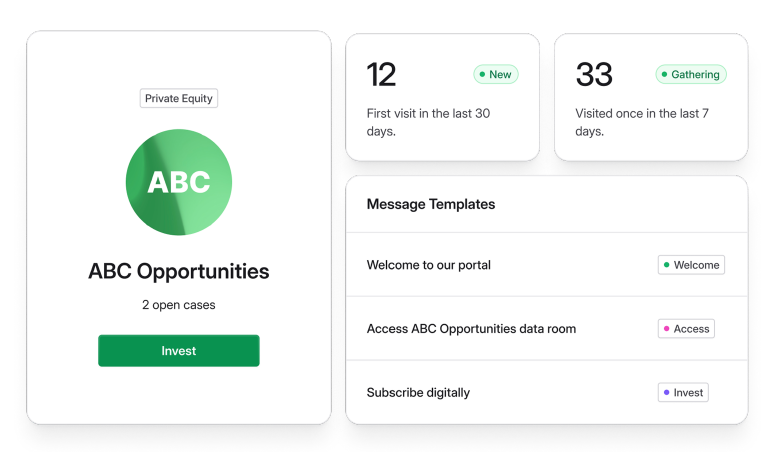

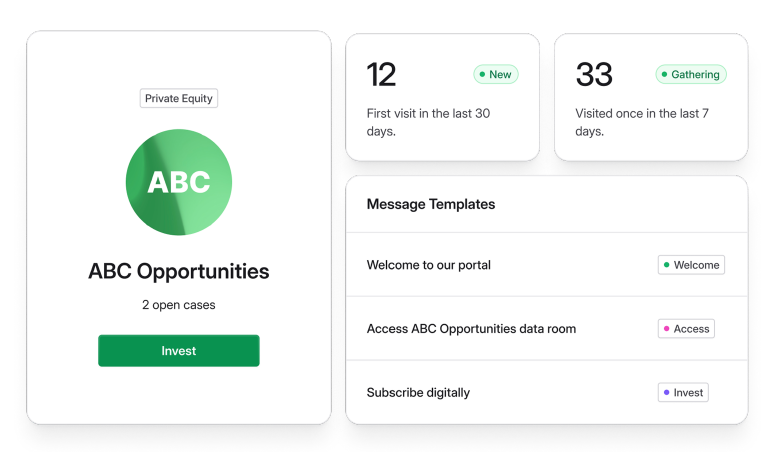

Fundraising

- Fund Administrators: Go beyond a basic investor portal—enable clients to expand their use of the portal for fundraising too.

- Fund Managers: Host your offerings, accelerate capital raising and scale distribution.

- Investors: Learn about new opportunities, conduct due diligence and stay informed.

Fund Administrators: Go beyond a basic investor portal—enable clients to expand their use of the portal for fundraising too.

Fund Managers: Host your offerings, accelerate capital raising and scale distribution.

Investors: Learn about new opportunities, conduct due diligence and stay informed.

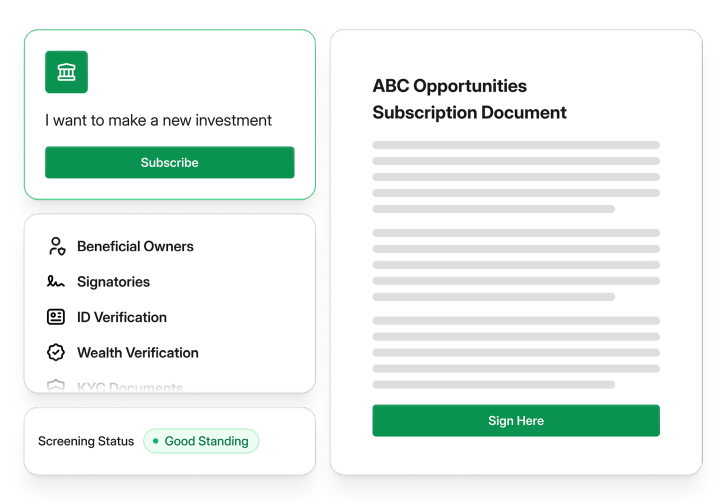

Investor Onboarding

Fund Administrators: Upgrade your investor onboarding workflows and operate at the center of fund subscriptions.

Fund Managers: Provide investors with a seamless experience and gain transparency over the process.

Investors: Onboard and subscribe in as little as a few clicks.

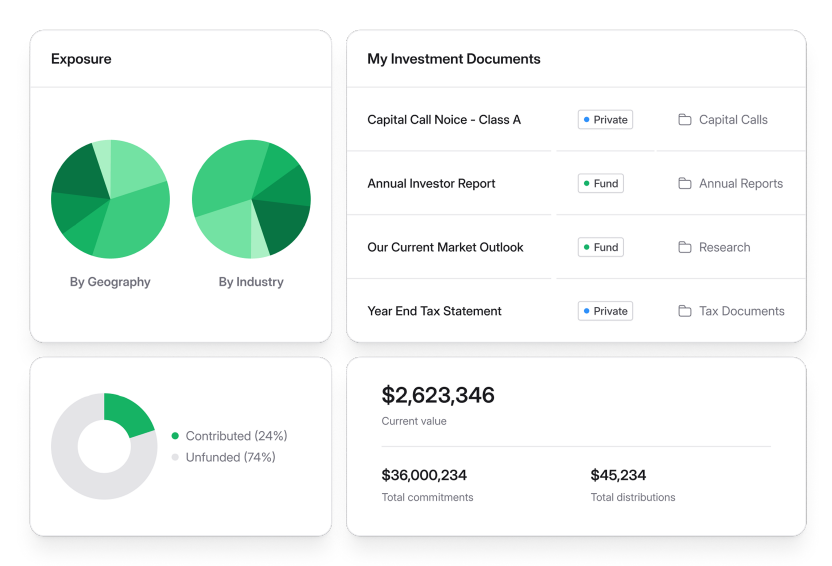

Investor Servicing

Fund Administrators: Everything from capital calls to statements, real-time dashboard data, and investor profile updates to service investors across your clients worldwide.

Fund Managers: Centrally service all of your investors in your environment, across fund administrators and your in-house teams.

Investors: Access investment documents, data and updates across your investments.

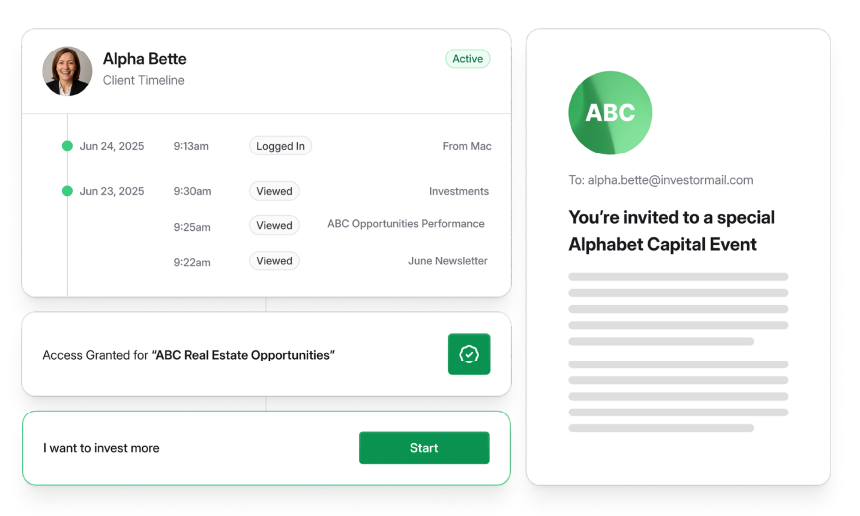

Ongoing Investor Engagement

Fund Administrators: Support follow-on investments, transfers, redemptions, investor profile updates, ongoing investor monitoring and more.

Fund Managers: Make it easy for investors to keep investing and stay engaged.

Investors: Invest more, update your profile information, manage your investment preferences, communicate and more.

Key Capabilities

A Complete Operating System

Packed with integrated modules and workflows to scale your investor servicing operations and growth.

Digital Transactions

The easiest and most digital way to make private investments.

Global Screening Hub

Complete workflows to monitor investors for regulatory compliance

AML Screening

Screen investors for AML, handle mandatory actions and stay informed.

Wealth Checks

Obtain third-party Accredited Investor and wealth verifications seamlessly.

Payments

Complete workflows for easy capital calls and distributions.

Investor Servicing

Complete workflows to power your entire investor servicing efforts for clients and offerings worldwide.

Investor Portal

An investor portal covering the entirety of the investor relationship.

Investor Dashboards

Enrich investor experiences with custom digital dashboards synced to accounting systems.

Virtual Data Room

Securely host document libraries for marketing, capital raising, due diligence and investor education.

We play well with others

API integrations help you do more

From syncing with accounting software to AML screening and simplifying your technology stack, Eleven integrates with leading service providers to take you even further.

Data Warehouses

Accounting Software

Fund Administrators

Artificial Intelligence

Tokenization

Digital Payments

Bank Verifications

ID Verification

Login Authentication

Email Relay

Wealth Verifications

AML Screening

CRM

Mobile App

Constant innovation

Eight generations of major solutions

Eleven lives at the forefront of innovation with a history of releasing game-changing solutions. OS8 is the newest and most exciting one yet.

OS1

OS1 was where it all began. Hedge Fund Investor Network was a pioneering online community for hedge fund investors to connect, vet ideas, ask questions and access actionable research, opinions, insights and intelligence and vet questions and ideas.

OS2

OS2 brought digital to hedge funds. Born from Hedge Fund Investor Network, HFIN One pioneered the first solutions-driven engagement platform and marketplace for the global hedge fund industry.

HFIN One uniquely combined marketing tools and data rooms with CRM and behavioral insights to help hedge fund managers drive investor engagement and transform their fundraising efforts.

Simultaneously, HFIN One also operated a single global network, providing hedge funds with exposure and access to new investors, and investors centralized access to managers, information, documents, communications and analytics.

OS3

OS3 scaled things up. We rebuilt the platform for enterprise-grade performance, unlocking a new wave of sophisticated workflows and bringing Eleven beyond a network into a centralized operating system for the hedge fund industry.

OS4

OS4 introduced marketplace aggregation. HFIN One evolved from a single open network to a network of marketplaces to powering distribution for RIAs, third-party marketers, capital introduction teams, family office networks, and other online marketplaces that wanted to digitally connect investors and products with scale.

OS5

OS5 welcomed Eleven. Eleven broke past the limits of HFIN One—moving beyond hedge funds to all private investment verticals, beyond fundraising to the end-to-end investment journey, beyond a single marketplace to a network of private marketplaces, and beyond two-sided solution to one that powers the complete ecosystem.

OS6

OS6 delivered breakthrough technology. OS6 introduced a number of industry firsts, including:

- The ability to subscribe to private investments digitally

- Straight-through processing of private investments

- Coupling KYC onboarding and digital fund subscriptions

- Enterprise-grade technology for fund administrators to scale investor servicing, increase revenue and offer a full lifecycle investor portal

- Multi-party transactional workflows across investors, investor contacts, fund administrators and fund managers.

OS7

OS7 transformed data flows. We transformed how data moves between Investor Profiles and investments, making complex workflows simple. OS7 delivered a new standard in private investment infrastructure, enabling Investor Profiles to be reusable and maintainable, including across different investment managers and fund administrators.

OS8

OS8 catapults investor onboarding. OS8 packs the power of standalone investor onboarding solutions into a fully integrated solution, transforms how payments are made in private investments, introduces more automation and integrations and takes investor experience even further.