Key features

The easiest way to meet 506(c) verification requirements

Investment managers offering 506c funds are required to verify that each investor is an Accredited Investor. Eleven makes the process faster, easier and compliant for everyone.

Best in class provider

Powered by iCapital’s Identity Solutions (formerly Parallel Markets), a leading provider of Accredited Investor verifications and trusted by top funds globally.

Powered by iCapital’s Identity Solutions (formerly Parallel Markets), a leading provider of Accredited Investor verifications and trusted by top funds globally.

Easiest investor experience

There's no need to send investors to another place just to verify their wealth or accredited investor status. The flow is seamlessly integrated into their digital subscription or onboarding process.

Regulatory compliance and shifted liability

Our verification partners meet the SEC requirements for performing verifications, providing Safe Harbor, moving liability from your team to the verification service provider.

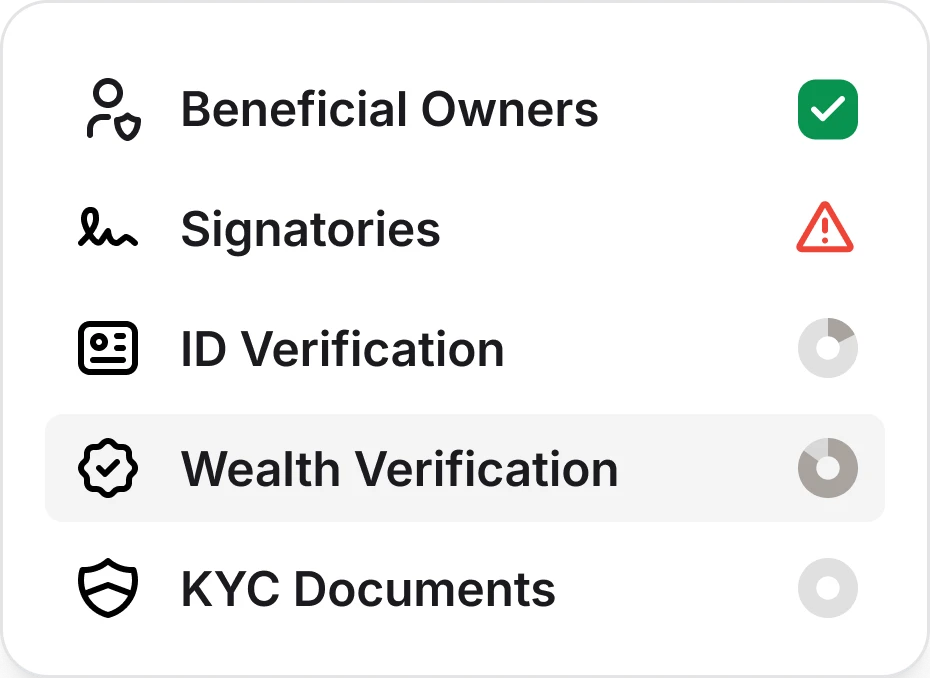

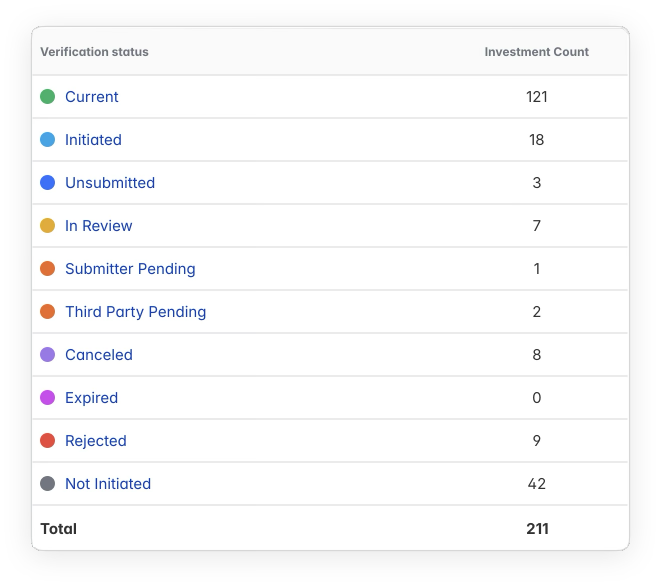

Real-time transparency over every step

See the status of every investor and verification, track expiration dates and usage, and automatically incorporate verifications into your KYC hub.

Skip the upfront commitments

No need to make any up-front commitments for estimated volumes or any platform fees. Just pay for verifications submitted.

How it works

Seamlessly integrated into the subscription workflow

No need to send investors to another place or have them upload information twice.

Initiate seamlessly in-portal

Investors begin the verification process seamlessly during their digital fund subscription in your investor portal.

Collect supporting documents automatically

Document collection is seamless, ensuring all necessary information is gathered during the transaction or onboarding.

Independent compliance review

Our partners conduct verifications that meet SEC requirements, providing you with peace of mind and legal compliance.

Shift liability to experts

iCapital's Identity Solutions / Parallel Markets offers Safe Harbor, shifting 100% of the liability from your firm to them, reducing your legal risk.

Get results in hours

Receive verification results often in 3-4 hours, significantly faster than the industry average, ensuring a smooth onboarding process for your investors.

Final verification letter included in your subscription package

The Verification Letter is included with the complete subscription package, including KYC documents and the subscription agreement.