Integrated is better

The power of the best standalone solutions—fully integrated into all things investor.

Screen, approve, monitor and review investors for compliance—in the same environment where they already onboard, subscribe and are serviced.

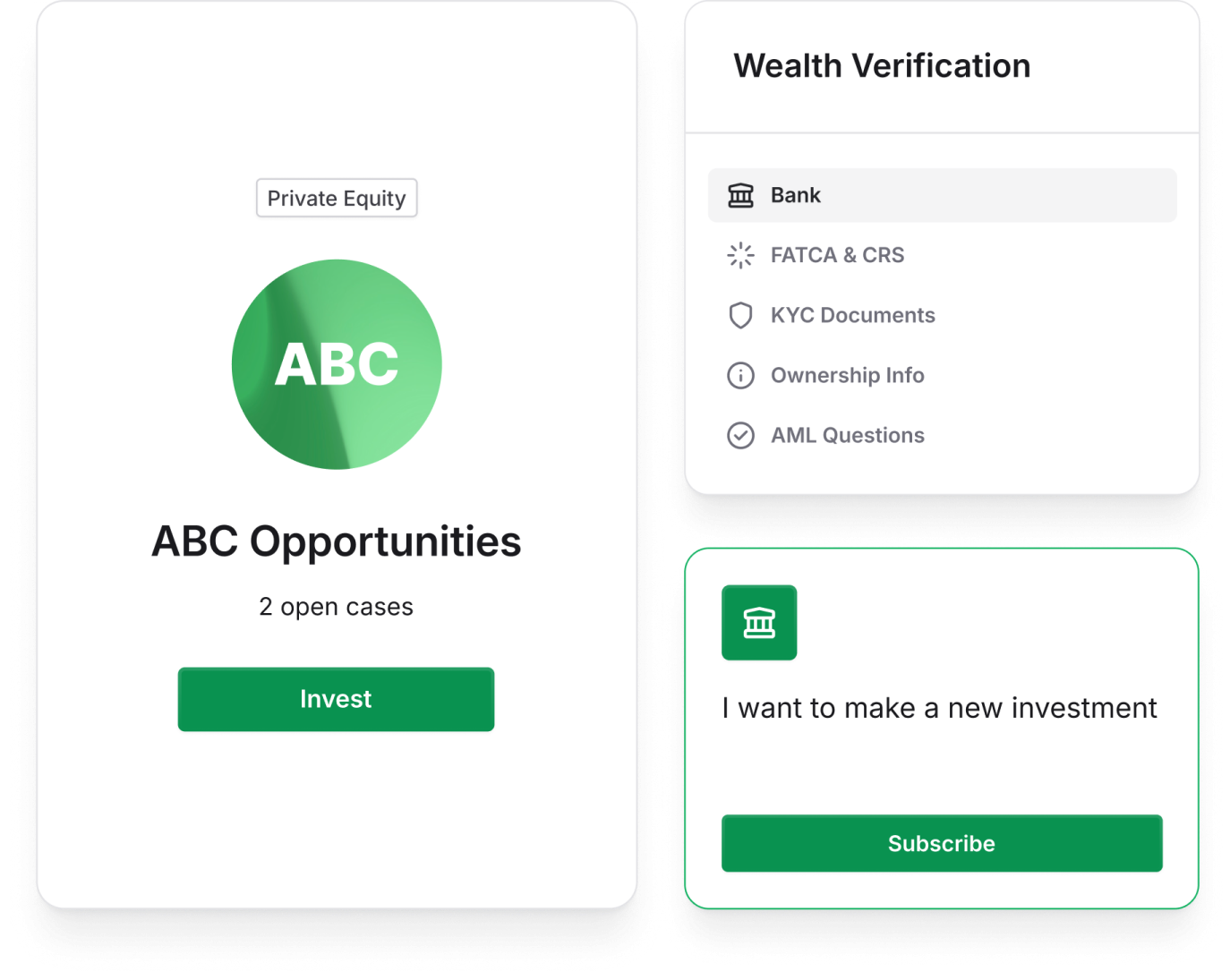

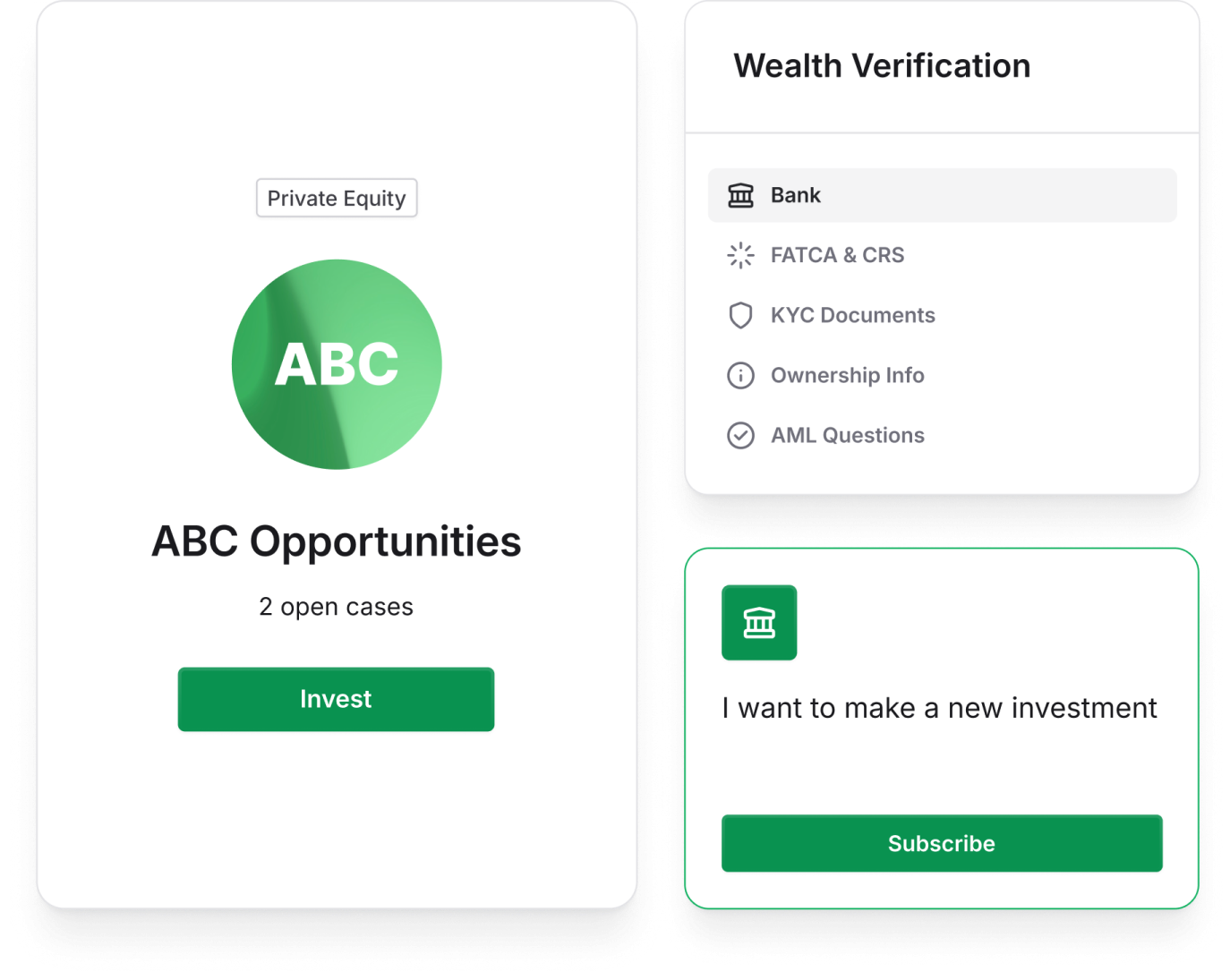

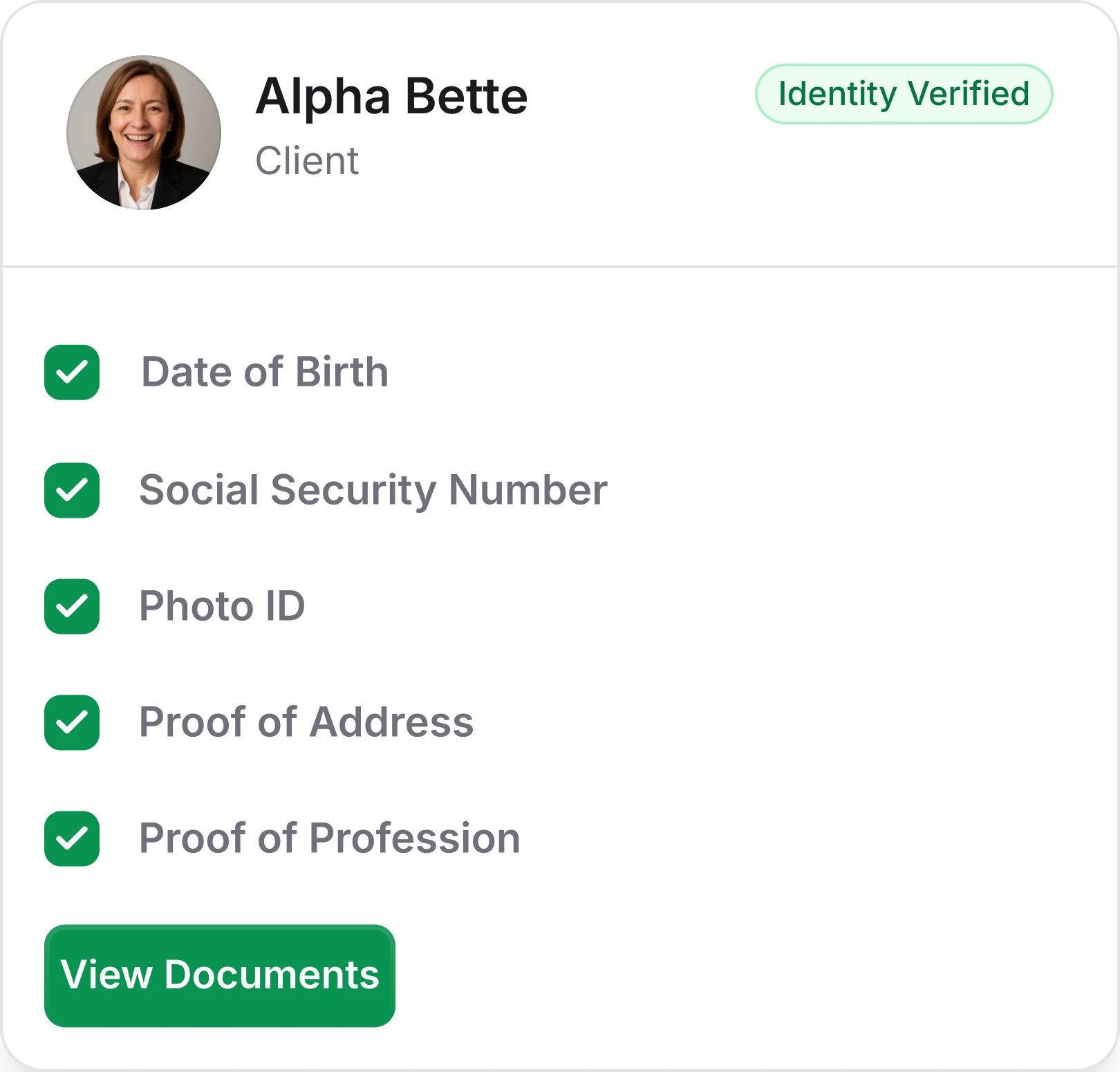

Synced with investor onboarding

Screening begins the moment an investor onboards or subscribes. KYC data, documents, beneficial ownership, and risk ratings all flow seamlessly into the global screening record.

Screening begins the moment an investor onboards or subscribes. KYC data, documents, beneficial ownership, and risk ratings all flow seamlessly into the global screening record.

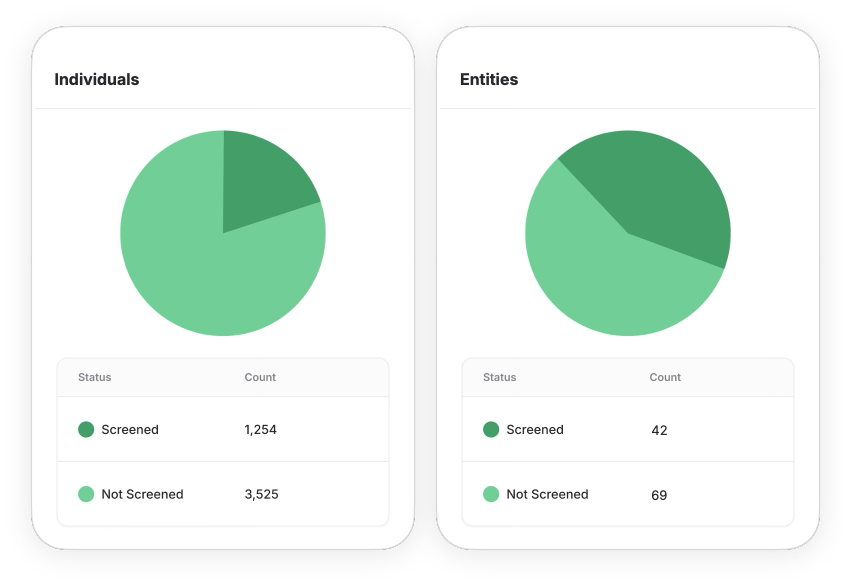

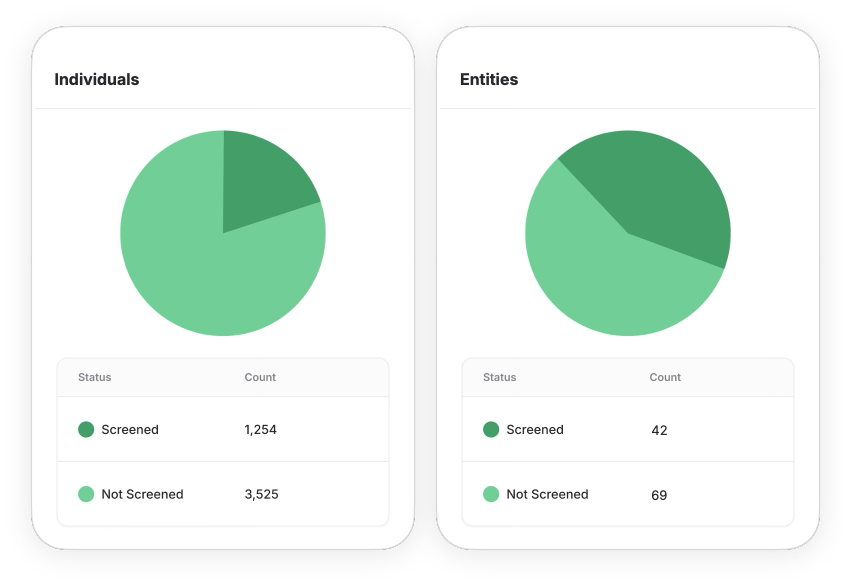

Centralized dashboard

View a complete roll-up of every investor’s status in one place. All screening elements are centralized into a single dashboard for full visibility at a glance.

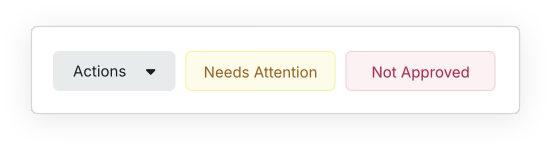

Computed and official screening statuses

Automatically computed with every change with manual overrides.

AML Checks

Leverage direct integration with Refinitiv World-Check for continuous AML screening and monitoring—fully embedded into your workflows.

Leverage direct integration with Refinitiv World-Check for continuous AML screening and monitoring—fully embedded into your workflows.

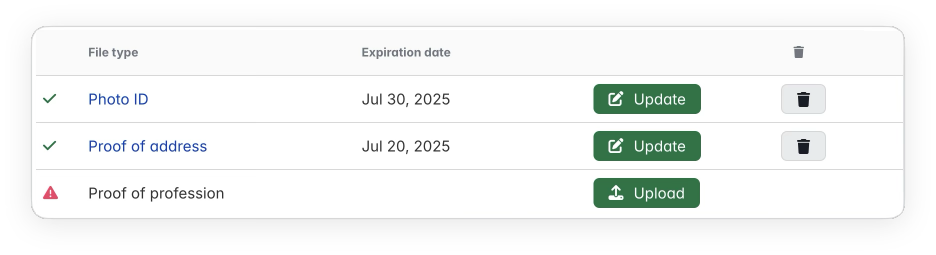

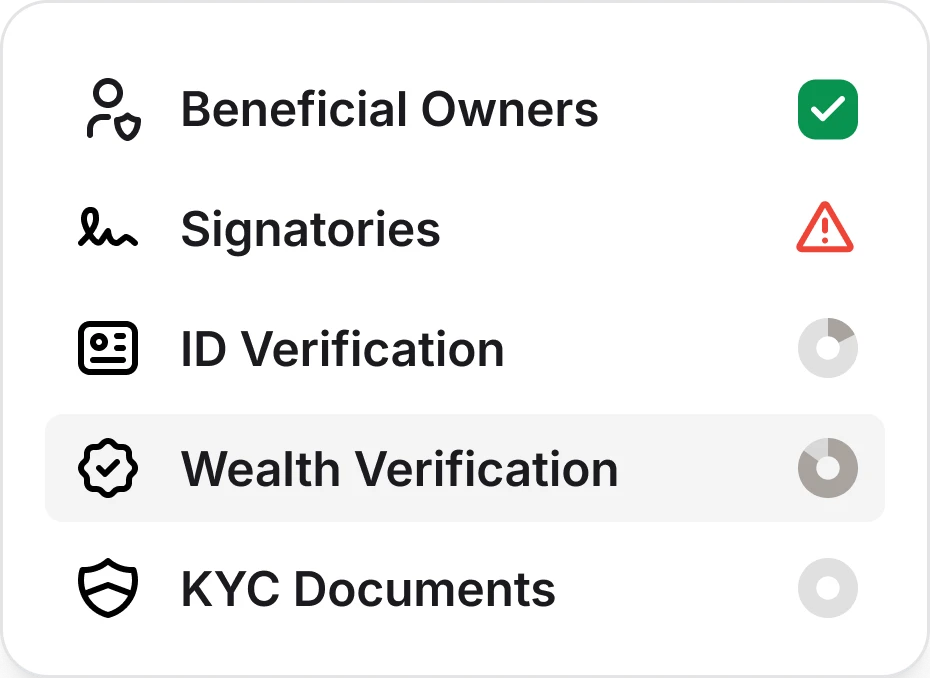

KYC Documents

Track and validate documents across entities and investor contacts, using your firm’s own KYC matrices and jurisdiction-specific requirements.

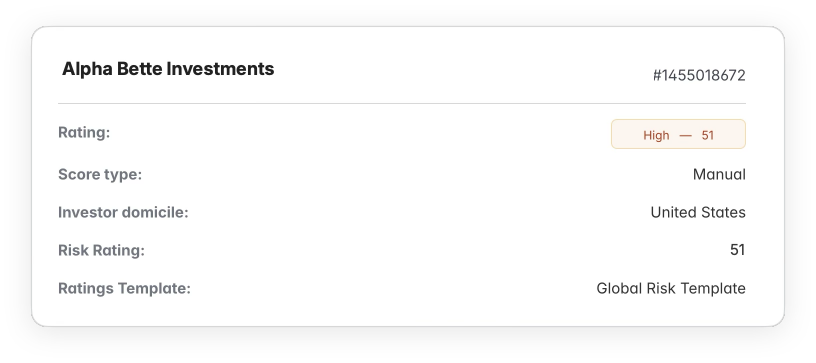

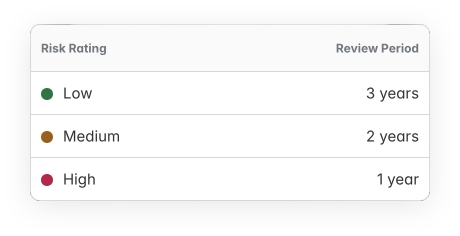

Risk Ratings

Apply your firm’s risk model to every investor profile. Scores are calculated automatically, with support for manual overrides when needed.

Wealth Verifications

Incorporate wealth checks directly into your KYC process, with integrations to leading verification providers worldwide.

ID Verifications

Incorporate identity verifications directly into the onboarding workflows.

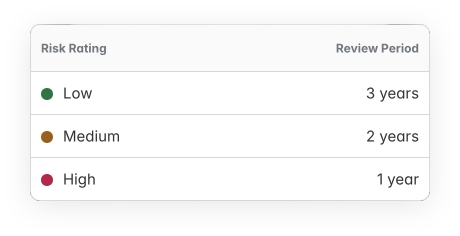

Periodic reviews

Populate client acceptance forms automatically and schedule periodic reviews by risk level. Receive alerts when it’s time for the next review.

Populate client acceptance forms automatically and schedule periodic reviews by risk level. Receive alerts when it’s time for the next review.

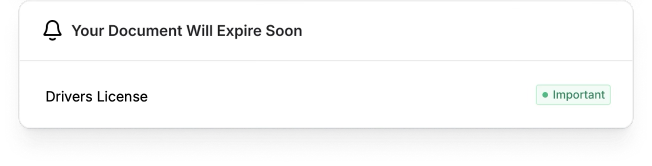

Automated updates and notifications

Get notified when anything changes—expired documents, updated data, new AML hits—so you can act before risks escalate.

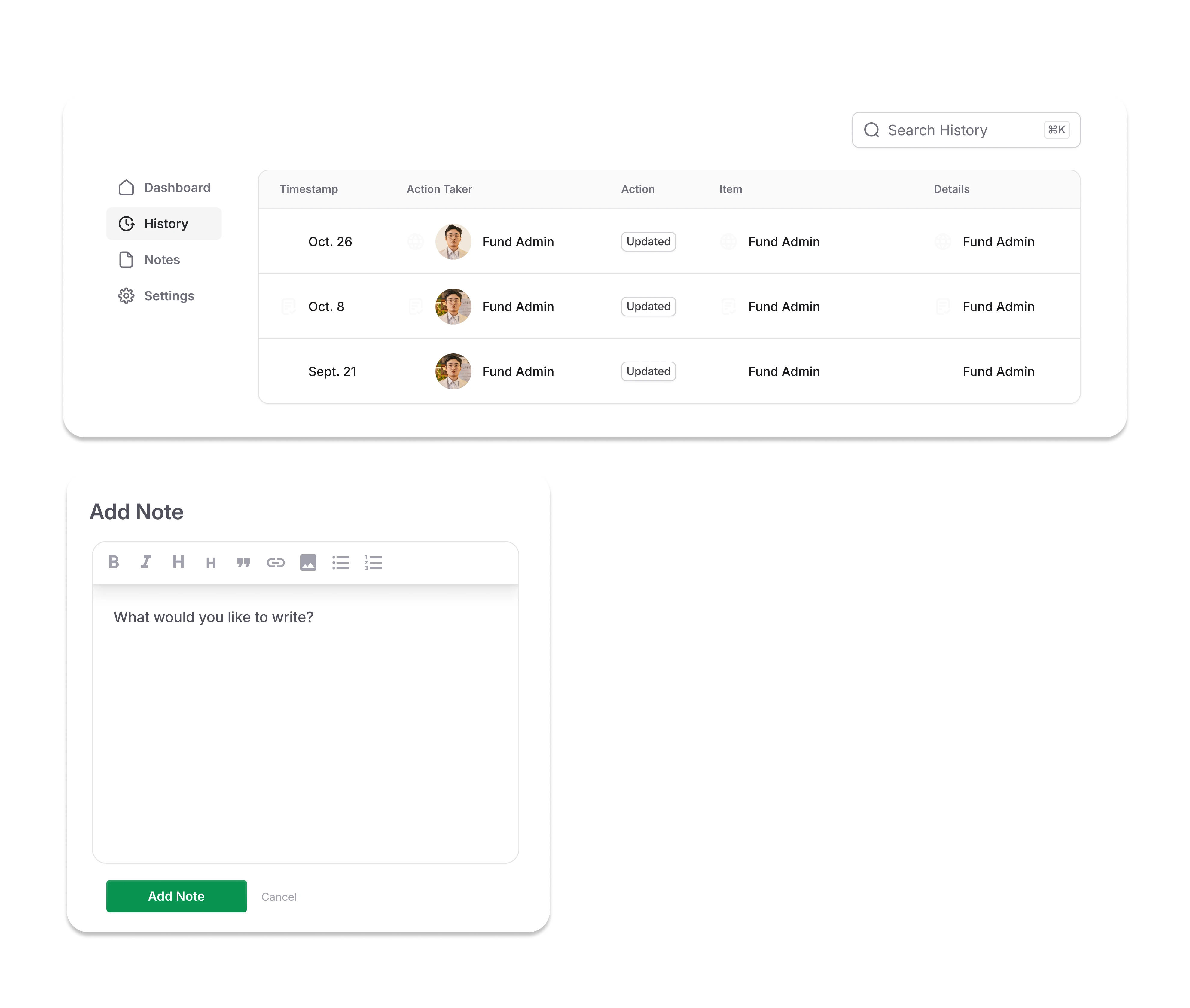

Screening history and notes

Every status change, document update, approval, override, and note is tracked for a complete audit trail, ensuring transparency and compliance.