NEW YORK, NEW YORK — OS8 is Eleven's most ambitious release yet, expanding and deepening every part of the private investment lifecycle on a single intelligent, connected operating system. From fundraising and investor onboarding to servicing, payments, and compliance, OS8 takes what was already a unified environment on Eleven and expands it with even more capabilities — streamlining every interaction between fund managers, fund administrators, and investors and providing new levels of connectivity, automation, information and control.

Complete with a refreshed and modern design system, OS8 is built for speed, scale, custom branding and exceptional investor experiences. It is packed with all the features you need to scale your work, tailor your environment, reduce costs, and deliver the simple and interactive experience investors demand.

New and big in OS8

Some of the transformative OS8 solutions include:

- Global Screening Hub — Centralized investor approvals and monitoring in one intelligent command center

- Integrated Payments — End-to-end and integrated capital calls and distributions with full tracking and automation

- Expanded KYC — New master template, matrix cloning, Investor Profile roll-ups, and easy KYC document migrations

- AML Screening and Monitoring — Fully integrated screening and monitoring without leaving the platform

- Preboard / Reboard Investors — Pre-qualify or fully onboard investors through KYC and AML before they invest

- Digital Transfer Wizard — Seamless investment transfers between investors

- Integrated Wealth Verifications — Integrated 506(c) accredited investor verification

- Introducing Elle — Eleven's built-in AI assistant

Global Screening Hub

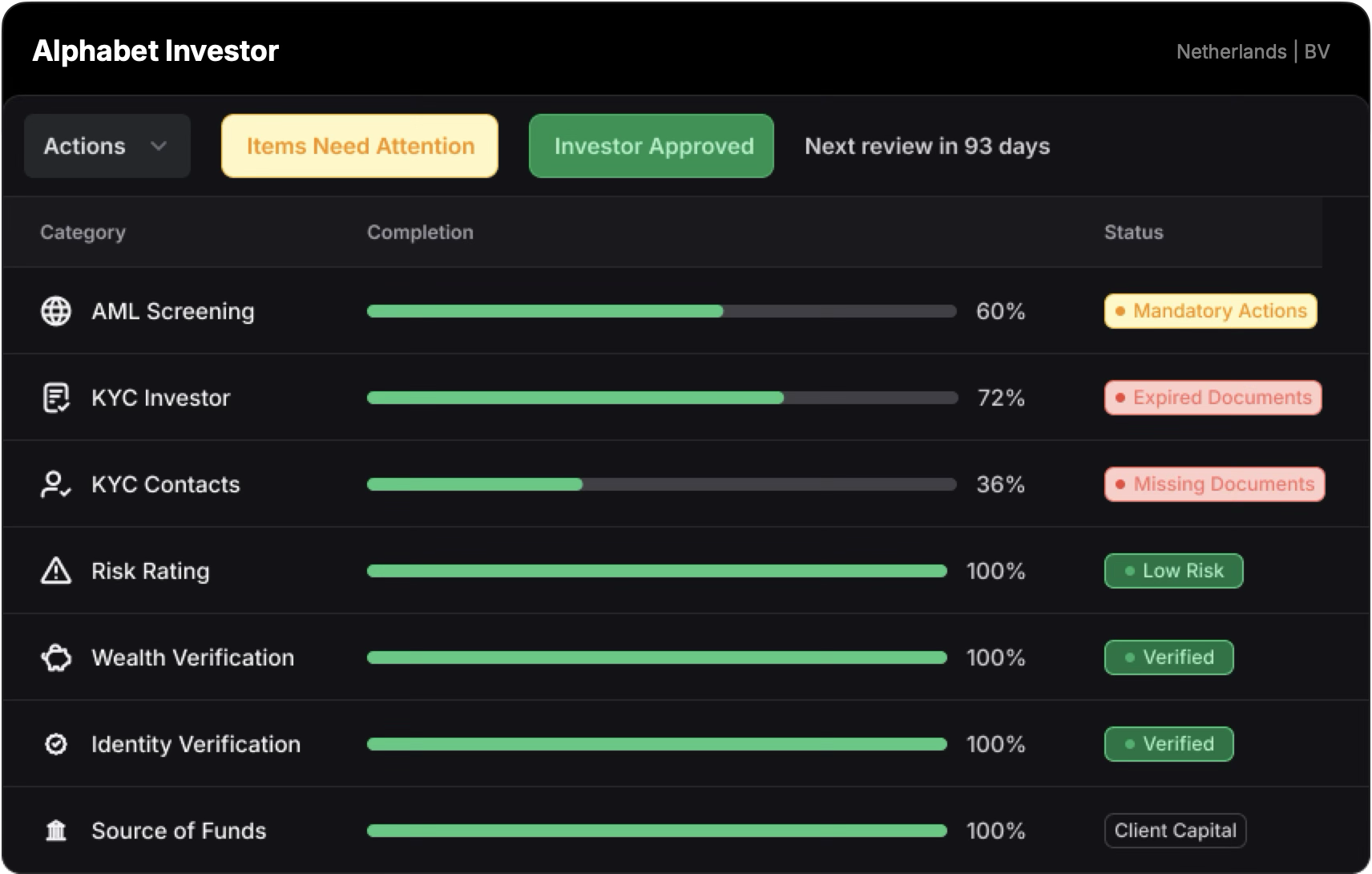

The new Global Screening Hub brings investor approvals and monitoring into one intelligent command center — always up to date, alerting you when action is needed, and deeply integrated with every investor record, subscription, and onboarding flow.

Built to handle everything from initial screening to ongoing monitoring, it supports sanctions and PEP checks, ID verification, risk scoring, audit trails, and configurable review cycles. Compliance teams can assign cases, track notes, configure alerts, and ensure nothing slips through — all in one interface. Whether you’re onboarding individuals, entities, or complex structures, the Screening Hub adapts to your policies and jurisdictions.

Designed for scale and built with real-world complexity in mind, it gives global enterprises and boutique managers alike the visibility, automation, and peace of mind they need — while saving time and reducing costs.

A centralized dashboard providing a holistic, real-time view for every investor, covering every aspect of your KYC/AML requirements.

Integrated Payments

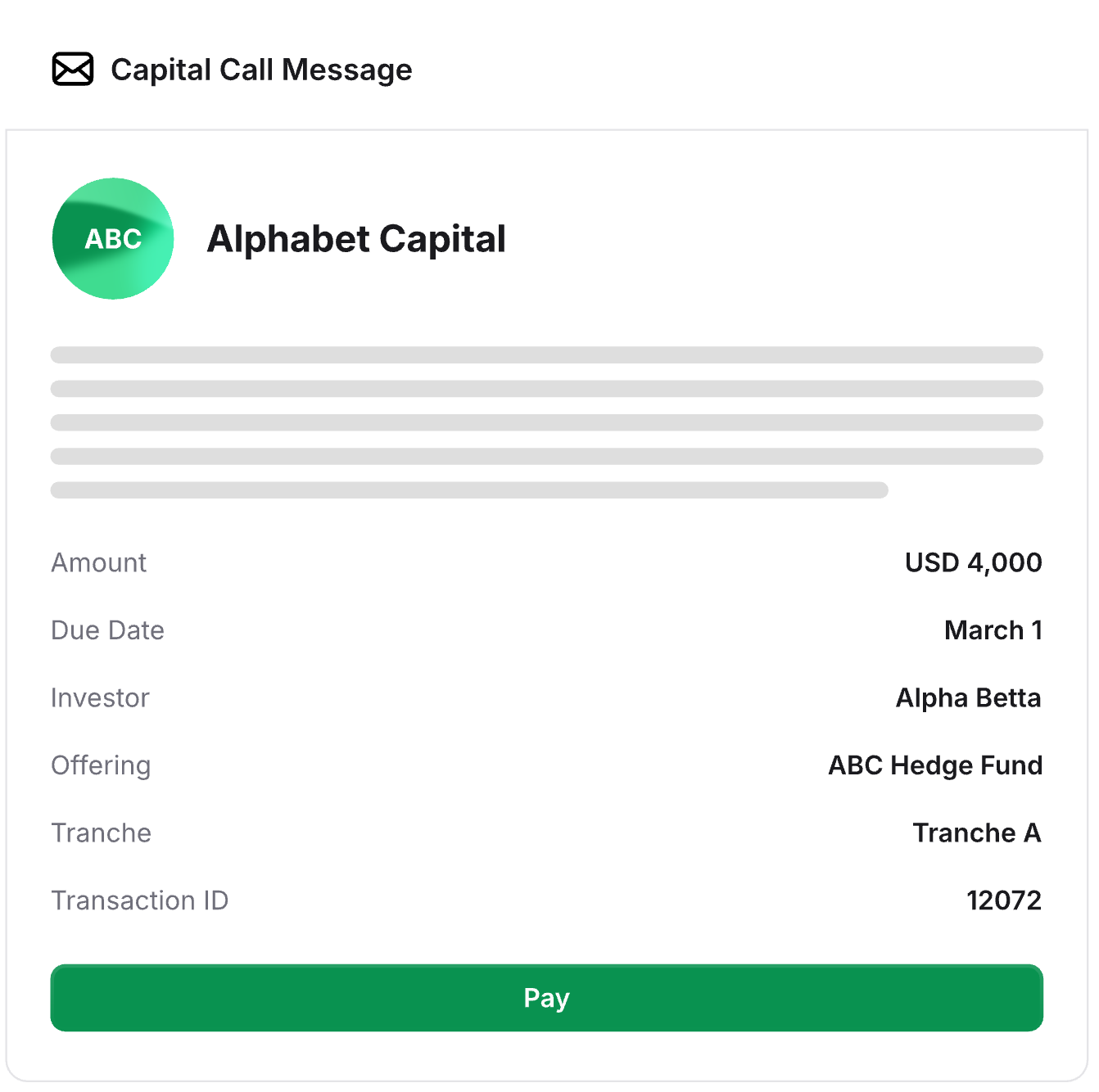

Transforming how capital calls and distributions run in private investments, OS8 introduces the most complete, intelligent payments solution, bringing every step of the capital call and distribution process into one unified system. It is built with every step of your workflow in mind to save you countless hours, cover the edge cases, and give you more oversight, accuracy and control.

Integrated Payments delivers full end-to-end transparency and automation across capital calls and distributions from accounting sync to investor notices, bank verifications, payment processing, payment reconciliations, approvals and more.

Whether you are a fund administrator processing payments for clients or an investment manager running capital calls and distributions in-house, this application will modernize your capital activity processes from end to end.

Customizable capital call emails with merged data and a button to pay.

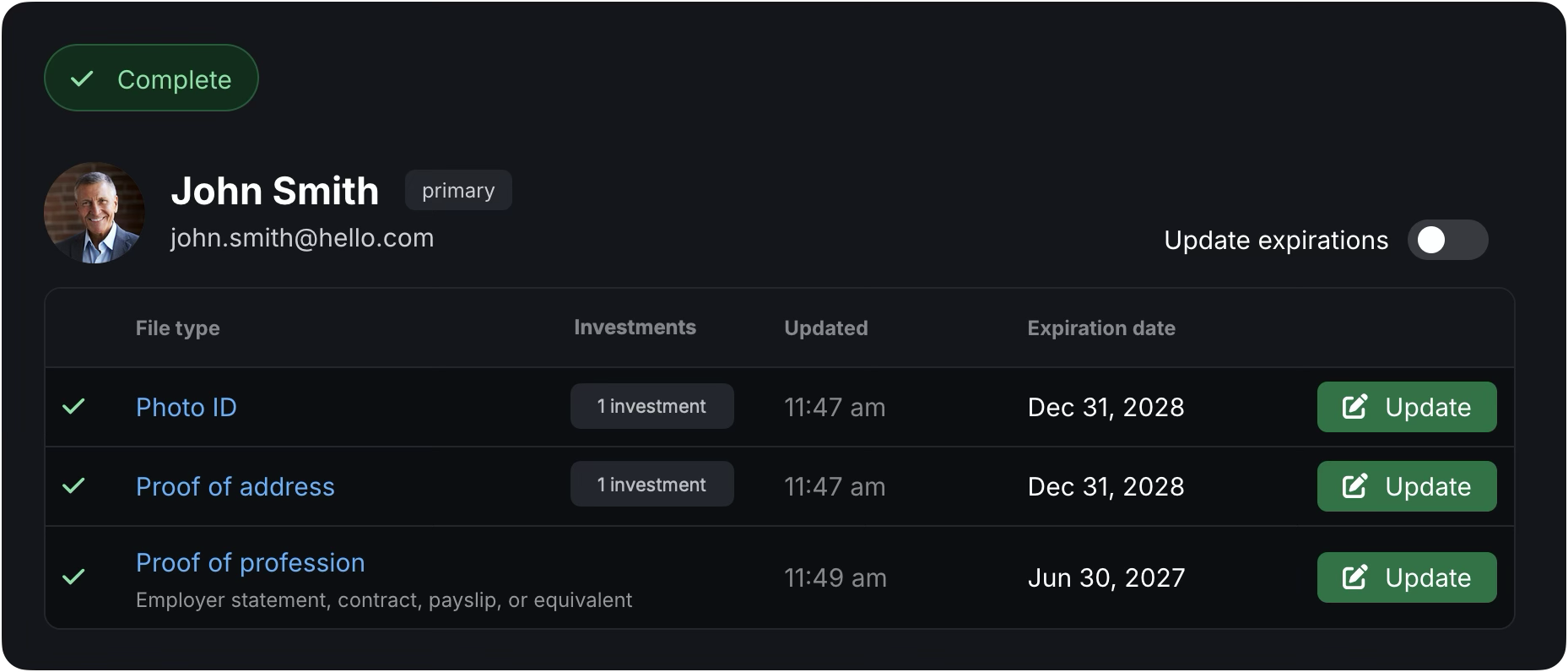

Expanded KYC

OS8 introduces powerful new capabilities that make managing your KYC requirements and centralizing and securing your existing KYC repositories, easier, faster and more powerful. You can obtain more precision over your KYC document requirements across investor types and jurisdictions worldwide, and maintain more accurate, current and complete KYC records on every investor and contact.

The Master Template. A new master template lets you centralize all of your requirements across every investor type around the world (and then apply those requirements across any or every jurisdiction).

- Cloning will save you hours. Our new cloning capabilities not only allow you to zip through setting up your KYC requirements, but also ensure your mappings are consistent and accurately maintained.

KYC across investments. KYC requirements often vary across investments and jurisdictions for the same investor. OS8 delivers a centralized investor-level view with drill downs into each investment, providing compliance teams with the simplicity, deep granularity and multi-layered approvals they need.

- Bulk KYC document migration. For KYC documents stored in external systems, OS8 brings expanded migration functionality, including bulk uploads and file organization workflows, so you can migrate, secure and sync your current KYC documentation across investors in minutes and create your approved Investor Profiles.

Integrated AML Screening and Monitoring

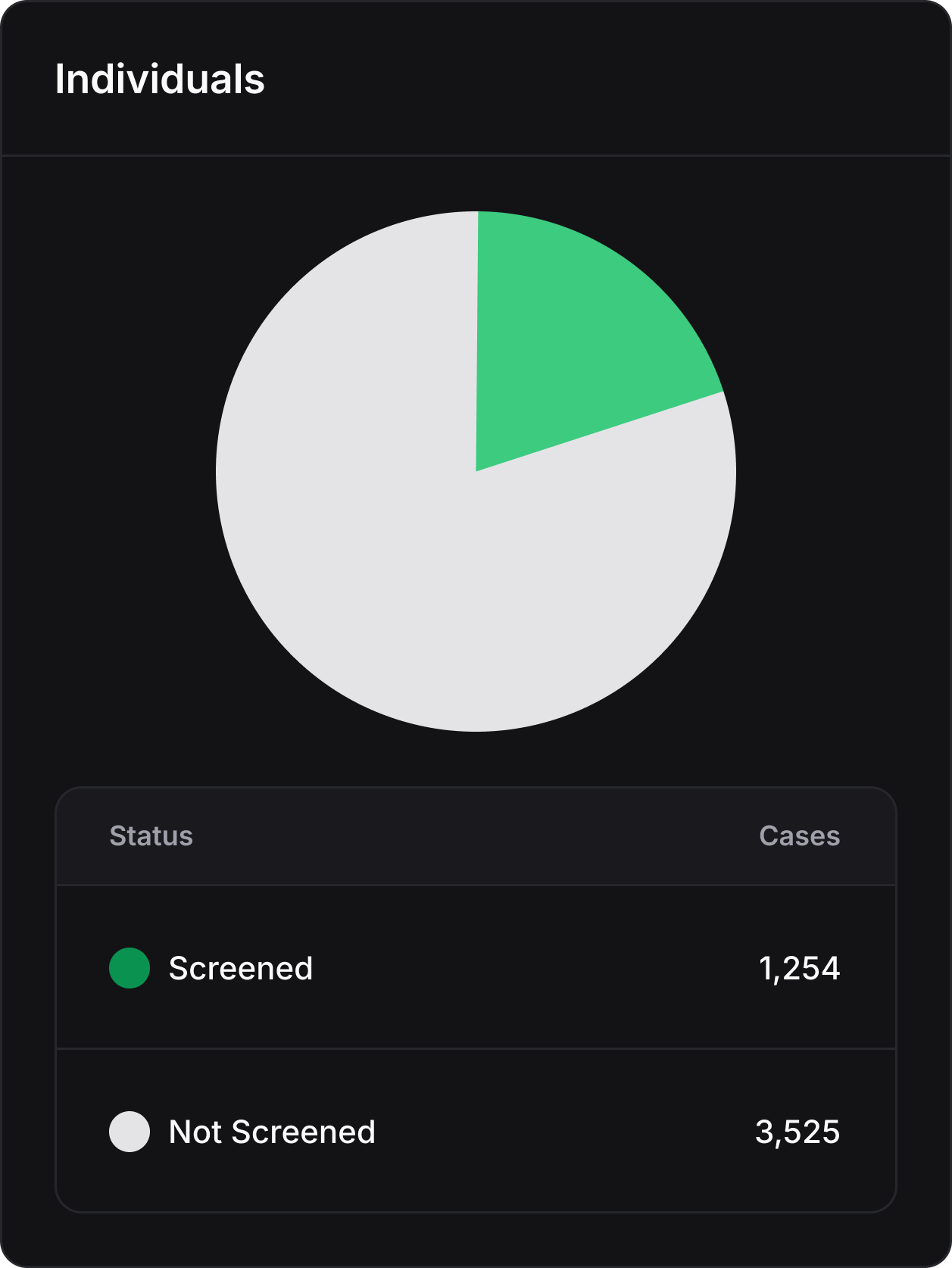

A new, fully integrated AML screening application lets you screen and monitor investors, and the applicable contacts and owners, for AML without needing to jump between systems.

With AML Screening, you can enroll team members for screenings, assign them cases and empower them to take action on open items. With two way syncing, it ushers in a new level of time savings, while making it easier to maintain compliance.

Real time dashboard showing contacts need AML screening.

Preboard / Reboard Investors

New and powerful preboarding workflows let you run either your prospective or existing investors through your KYC requirements and AML checks—apart from any investment. You can pre-qualify investors and prepare and approve them to invest in any of your offerings. You can also run existing investors through the onboarding to refresh or populate their Investor Profiles, enroll them in Global Screening, and re-qualify them for future investments.

Fully integrated workflows to collect information and documents from investors, and perform all your regulatory checks, before they invest.

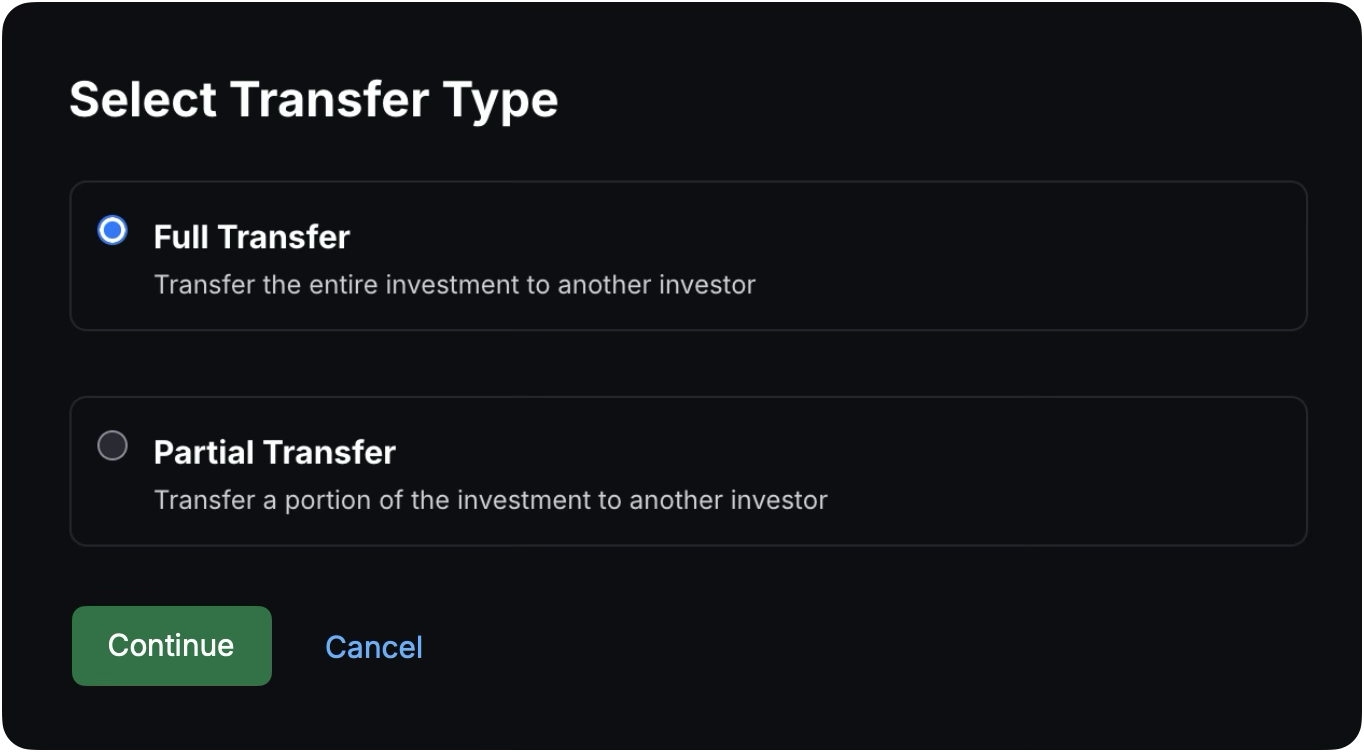

Digital Transfer Wizard

Transferring investments can now be initiated, approved and displayed for both the outgoing and incoming investor, in a simple and seamless workflow. From balances to transaction ledgers, everyone will have the complete picture.

A digital workflow for initiating and completing transfers of investment between two investors.

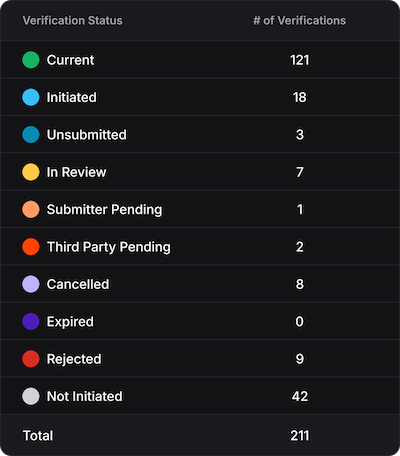

Integrated Wealth Verifications

Verify Accredited Investors for US Rule 506(c) directly and seamlessly within the Investor Portal. Investors complete their verification as part of their digital subscription or onboarding process without duplicating any steps or having to leave the platform. Fund managers receive real-time transparency over each verification and the verification letter automatically becomes part of the investor record.

Monitor the status of every wealth verification as part of any investor onboarding or subscription.

Other features

OS8 also brings hundreds of other features, big and small, spanning the entire platform, from customer-driven features to front-end enhancements, accounting connectivity and all things API:

About Eleven

Eleven is a disruptive technology company bringing the alternative investments industry online to a more connected, scalable future. Eleven enables participants throughout the private investment ecosystem to create engaged client communities, automate workflows and scale growth.

With Eleven, fund managers can onboard, engage, and service investors in a fully branded digital experience from fundraising to onboarding, investor servicing and ongoing engagement while fund administrators gain a complete infrastructure to streamline operations, scale investor onboarding and servicing, and unlock new revenue opportunities.

Trusted by leading firms around the world, Eleven is SOC 2 Type I and II certified, headquartered in New York, and operates globally. To learn more, visit platformeleven.io.