Powerful and easy

The world's most advanced, intuitive online transaction experience for private investments

Everything you need for electronic investing and processing, anywhere in the world.

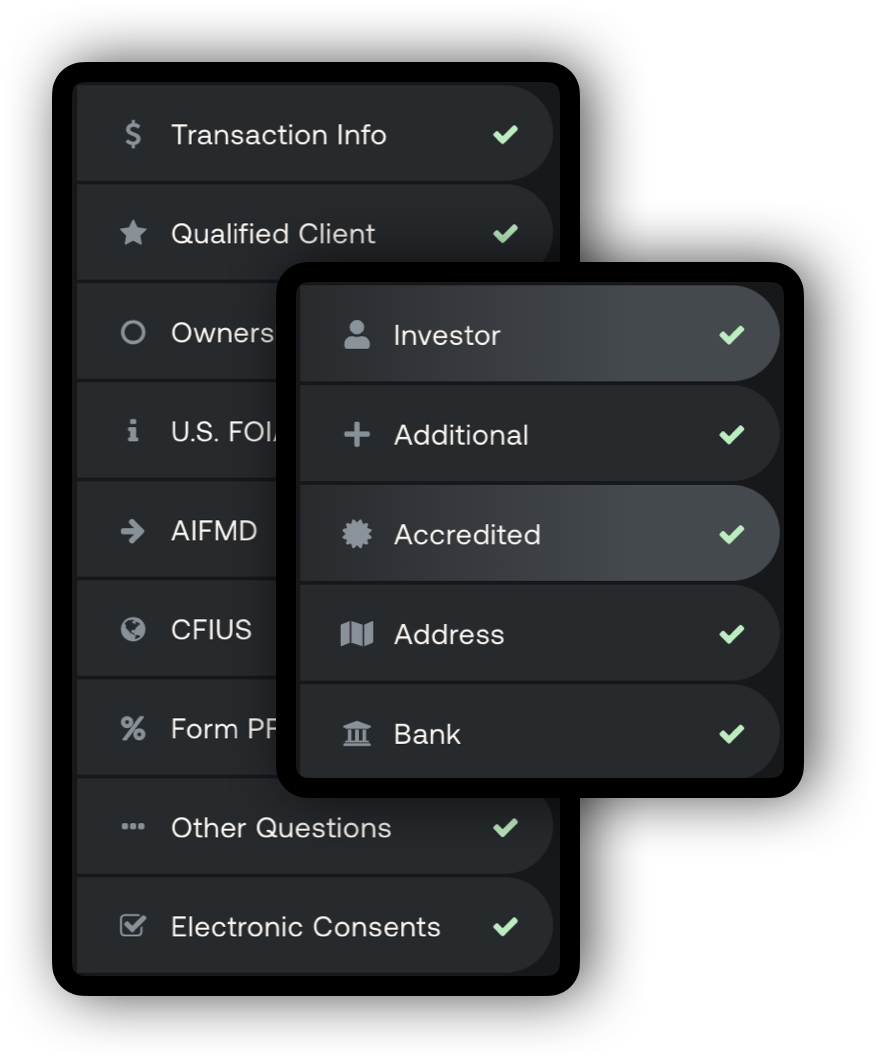

A complete experience

Imagine your clients, their investors and you connected in the same environment.

No other technology brings together all parties of a transaction together like Eleven. With you sitting right at the center, you will be bringing more collaboration, transparency and value to each transaction and everyone involved.

Welcome to straight-through processing for private investments.

Start with one client—and scale.

Launch without any major upfront costs, development work or time commitments.

Setup your first client

Eleven will create a license for you to launch a digital transaction for your first client and be connected on all sides.

Generate revenue

Earn additional revenue and in multiple ways from participating in the digitization process to earning additional licensing revenue.

Process transactions faster

Enjoy accurate submissions, completed KYC packages, full audit trails and integrated workflow tools, so you can review, process and approve transactions faster than ever before.

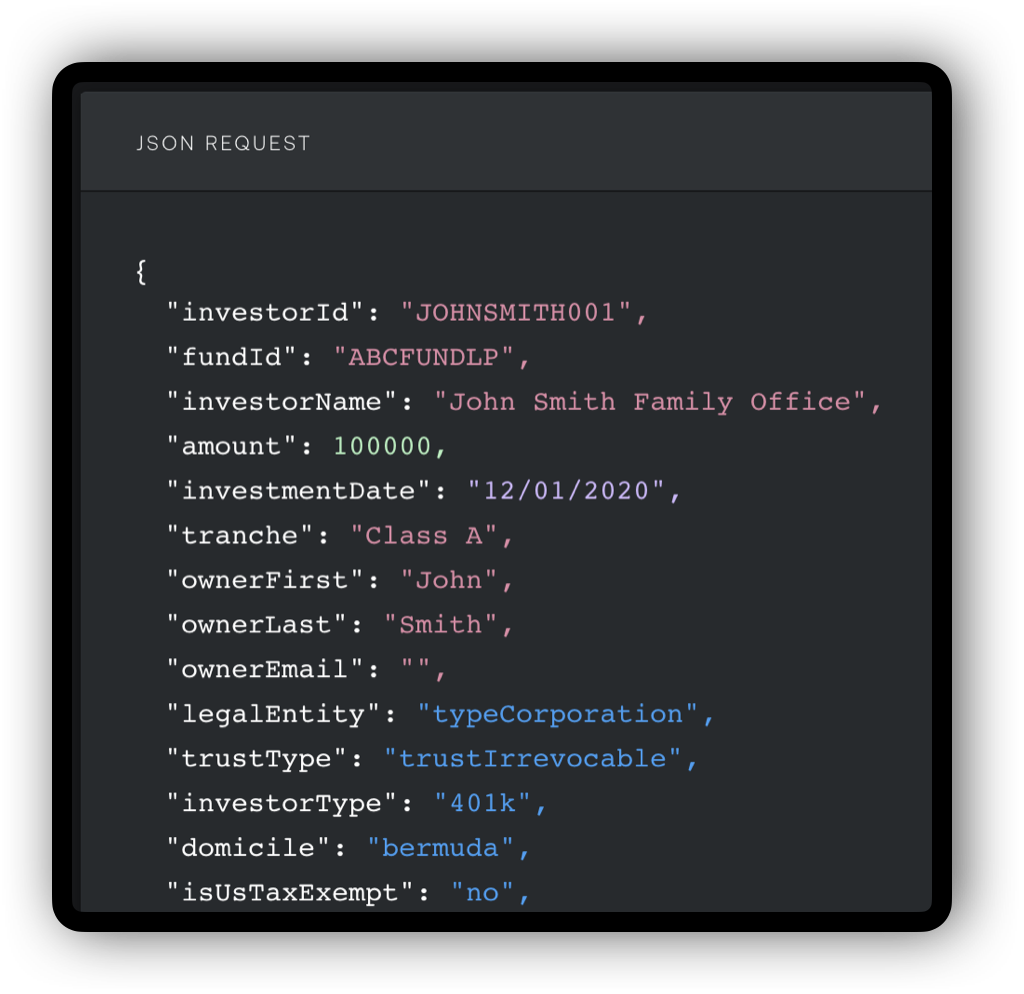

Sync data automatically

With APIs and/or export functionality, you can eliminate the need to manually transfer data in scanned documents to your accounting software. On Eleven, the transaction data lives in digital form.

Keep launching

There's no additional paperwork to launch more transactions for more clients, or more digital transactions for your existing client, such as additional investments and redemptions.

Keep servicing

Continue beyond the transaction

Unlike standalone digital transaction software, you can continue servicing investors and their contacts after the initial subscription is submitted—in the same client portal where the transaction was made.

- Deliver documents, including capital call notices and monthly statements

- Create stunning, data-driven dashboards

- Manage investor contacts and permissions

- Scale your investor servicing and onboarding workflows

We have you covered

From enterprises to individuals, you will enjoy the most comprehensive, integrated, relevant and easy-to-use tools available in a online transaction application. Once we release something, we do not stop there. We endlessly roll out new features and improve what we have. The best part is that we take feedback directly from you, our user.

Investor assistance

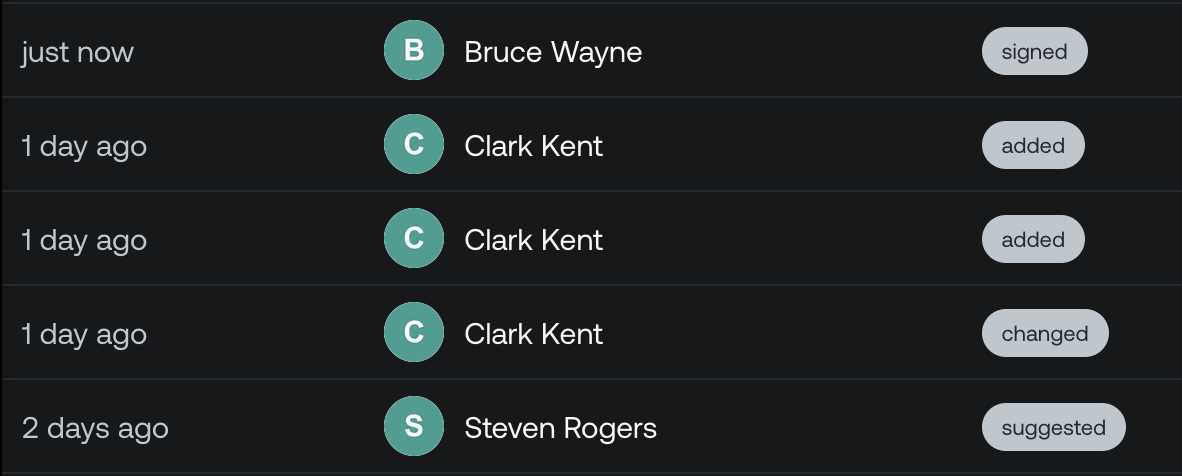

Suggest changes

Revoke signatures

Approve investments

Data logs and audit trails

Electronic signature workflows

General Partner signatures

Accepted investment amounts

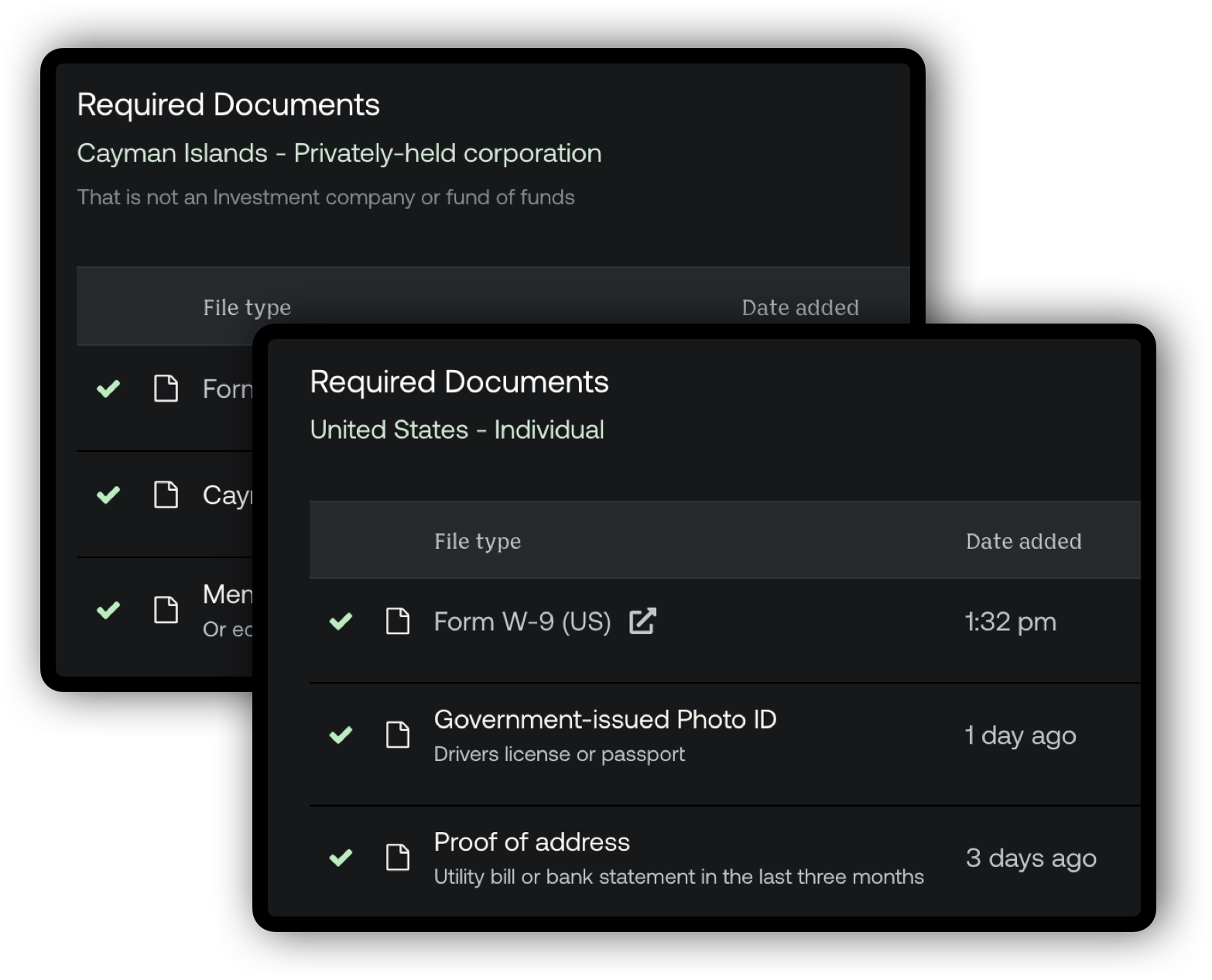

KYC documents

Investor contacts

Bulk downloading

User roles

Fund subscriptions

Additional investments

Redemptions

SPVs

More...

The infrastructure to power your team—and your growth.

Built for you

This module has been built in collaboration with our clients to give you the specific, enterprise-level solutions you need. Not just that, but we also ensure you have the easiest to use, easiest to implement and most powerful set of tools available for your company, your clients and you.

We keep innovating

We endlessly release new features, upgrades and improvements, and respond aggressively to feedback from our users.

Compliant, reliable and secure

Eleven is a SOC 2 Type 1 and Type 2 company. Our systems have over 99% uptime, are scalable and redundant.

Highly modular

This means using what you need. Enterprise systems can take companies a long time to roll out, but Eleven makes technology really easy to adopt and scale as your usage and needs grow.

We care

We love forming deep, quality partnerships with our clients. It is how we build things specific to your needs. We measure our success by how much your team loves the Eleven technology.